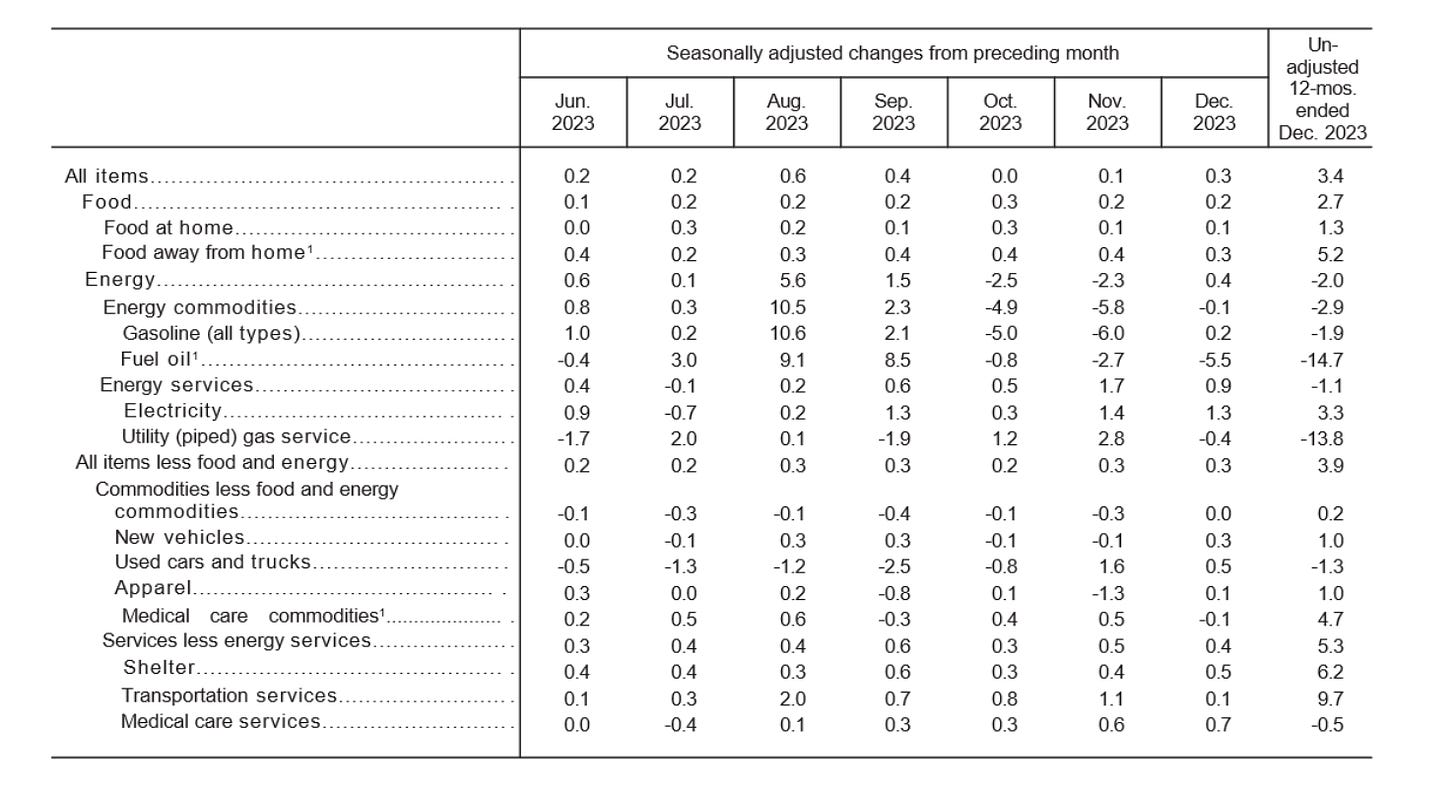

December CPI report was out this morning. Headline CPI MoM rose 0.3% in December vs. 0.1% in November, 0% in October, 0.4% in September while the core CPI MoM rose 0.3% in December vs. 0.3% in November, 0.2% in October, 0.3% in September. Headline CPI YoY rose 3.4% in December vs. 3.1% in November, 3.2% in October, 3.7% in September, 3.7% in August, 3.2% in July, 3% in June, 4.0% in May, 4.9% in April and 5% in March. Core CPI YoY rose 3.9% in December vs. 4% in November, 4% in October, 4.1% in September, 4.2% in August, 4.7% in July, 4.8% in June, 5.3% in May, 5.5% in April and 5.6% in March. Indexes which increased in December include shelter, motor vehicle insurance, and medical care. The index for household furnishings and operations and the index for personal care were among those that decreased over the month.

Core CPI is stuck at 0.3% MoM. I seriously doubt we will see the first rate cut in Q1. Hopefully, core CPI will continue to trend down slowly and we can get a few rate cuts for 2024. I feel many investors are overly optimistic about the rate cuts and expect 6+ cuts this year. That will probably only happen when something is seriously wrong. If the landing is soft, most likely we will only see 3-4 cuts this year.