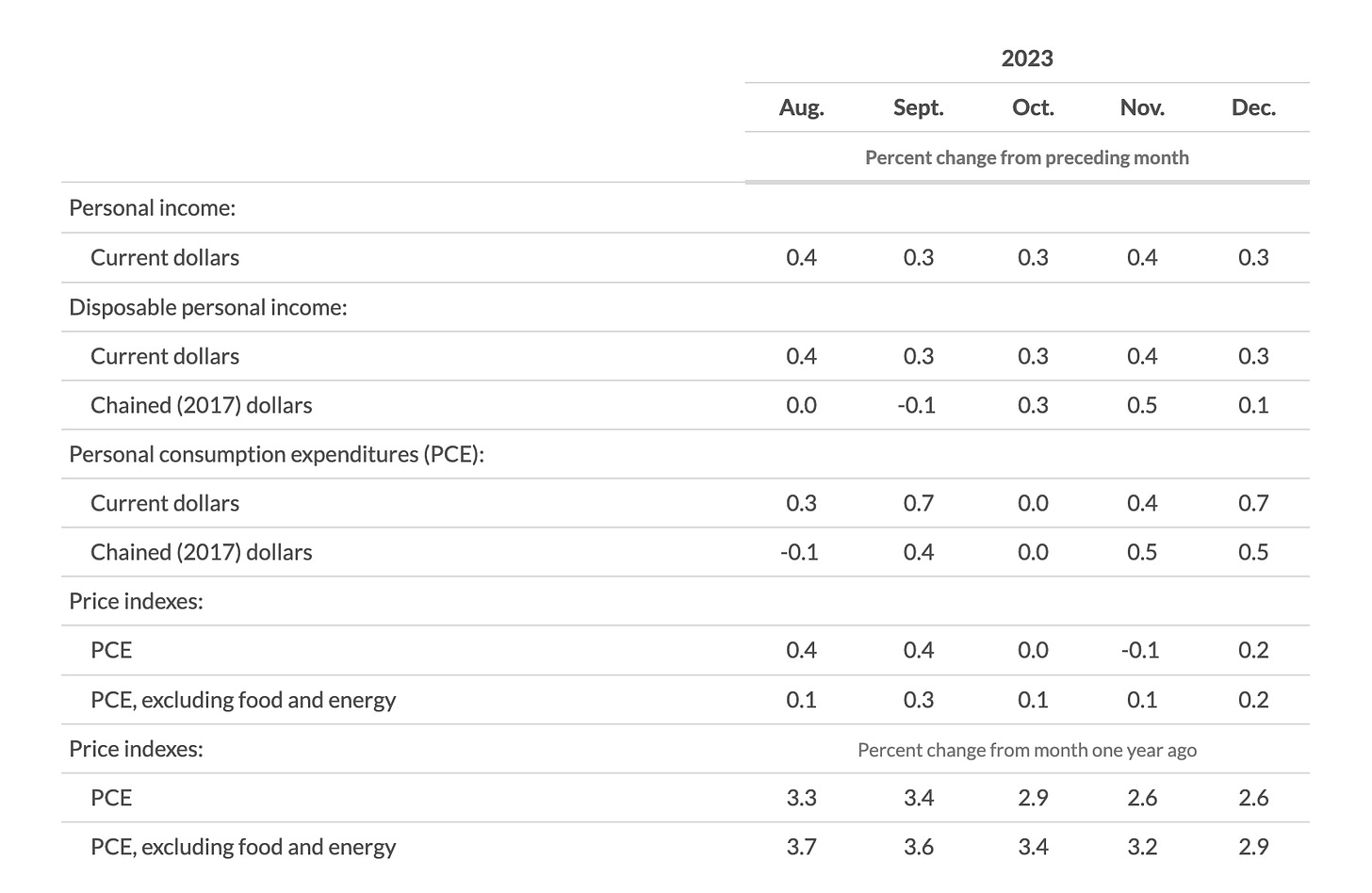

The December PCE report was out this morning. Both headline and core PCE price indexes went up went up 0.2% MoM in November. Core PCE inflation is the 2% target the Fed is trying to optimize for. Core PCE continues to trend down on an annualized basis and is now at 2.9% YoY. We are finally below 3% core PCE!! If core PCE continues to trend down for a few months, the Fed will probably feel comfortable cutting rates in Q2. RRP balance went down from 1.08T in late October 2023 to 570B today. With this rate of change, RRP balance will likely get down to zero in Q2 this year. A couple of days ago, the Fed also announced on March 11, 2024 they will stop making new loans from the BTFP program they launched last year after the SVB fiasco. Q2 2024 is going to be an interesting quarter with many monetary transitions happening. I am slightly scared.

Discussion about this post

No posts

It seems like the Fed will achieve its soft landing! The GDP figure for the US economy was impressive.