1/4/2023: 2023 Prediction: Battered SaaS Stocks are Now Reasonably Priced

It's a good time to buy cloud stocks with low PS ratio

2022 was brutal for SaaS companies. Even the bellwether SaaS company, Salesforce, was down 50+% from ATH and the company just announced that they are laying off 10% of its workforce. SaaS companies as a whole are experiencing a corporate spending slowdown and many are down 80+% from their ATH. According to the data published in May 2022 as shown above, the median Enterprise Value to ARR ratio had dipped from 16 to 7, which was already below the historical mean of 7.9. Fast forward to Nov 30, 2022, the ratio has gone down further to 6.3, which is actually good news. The valuation reset presents opportunities to invest in high quality companies at reasonable valuations. I believe many high growth SaaS companies are now investable and in a way they are less risky than big tech companies like Microsoft and Apple, which have become overvalued crowded trades.

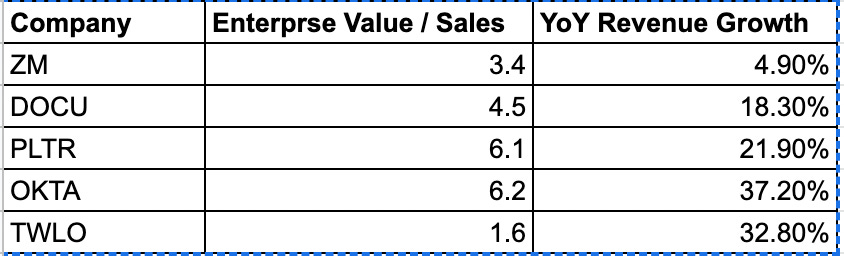

This is quite speculative but I predict that the high growth SaaS companies with low price-to-sales ratios are going to do better than SPY 0.00 for 2023. More specifically, I think the following five companies on average are going to do better than SPY 0.00 .

All five companies have $1B+ annual revenue, are cash flow positive with positive revenue growth and have below average price to sales ratios. I believe all 5 companies have sufficient scale to weather this downturn. Given that investors in general have pretty low expectations for these companies, they might end up beating expectations a lot and their stocks will do better than SPY 0.00. Please keep in mind that *better* doesn’t mean *positive*. It’s possible that SPY 0.00 falls 30% and these stocks only fall 20%. In that case, they will do better than SPY 0.00 but still lose money as a whole.

While I like this prediction game, nobody really knows the future. I am making these predictions primarily from the value and sentiment perspective. These stocks were battered so much that investors are afraid of dipping their toes into them and that’s precisely why it's a good time to invest in them. These companies have strong fundamentals and recognizable brand names. Now investors can finally buy their stocks at reasonable prices. Chances are these discounts won’t last very long.

Note: 1) Nothing written in this blog constitutes investment and/or financial advice. 2) I am a shareholder of ZM 0.00%↑ and OKTA 0.00%↑

I go back and forth on this. If you have a look at 2000-2003 the Russel out performed the nasdaq. Similar patterns did occur as well in the 1970s. However they still trended down. So they certainly seem to be a less bad option.

FCF yield(buyback + dividend adjusted) is our baseline financial metric. We then apply a whole munch of others.

I've tracked the first three names fairly closely for the last 2 years.

With ZM and Docu - I don't think their moat is defined enough to maintain margins. They are not very operationally complex products IMO and easily substituted for by companies looking to reduce costs.

I like PLTR. My big concern is their buy revenue model and small high growth tech customer concentration. What type of churn will they see as some of these clients close shop or cut contact size? If you back out their bought revenue, what would their actual growth have been? Basically I need to rebuild revenue growth and forward looking growth which I haven't had time to do yet. I do think they are differentiated enough to defend margins.

Thoughts?