After failing to clone myself with character.ai, I decided to build it myself with OpenAI API. I ingested all my blog content until 4/14/2023 and built the YFJ Bot that thinks and talks like me. I am pretty impressed with the results. See the Q&A I generated below. 7 out of 10 YFJ Bot answers below totally sound like mine. 2 are satisfactory. The only answer that is not very good is for the question “Do you think the Fed does a good job?” But after I update the model with the latest data, the answer becomes much better.

I think I will write my blog from scratch for another year or so. Then I will hand it off to my AI clone YFJ Bot. If interested, you can ask YFJ Bot any question by running this jupyter notebook and plugging in your own OpenAI API key. (Make sure the json data files are also downloaded under the same directory.) I do hope I can get access to the gpt-4 models so I can put in longer context to generate better results.

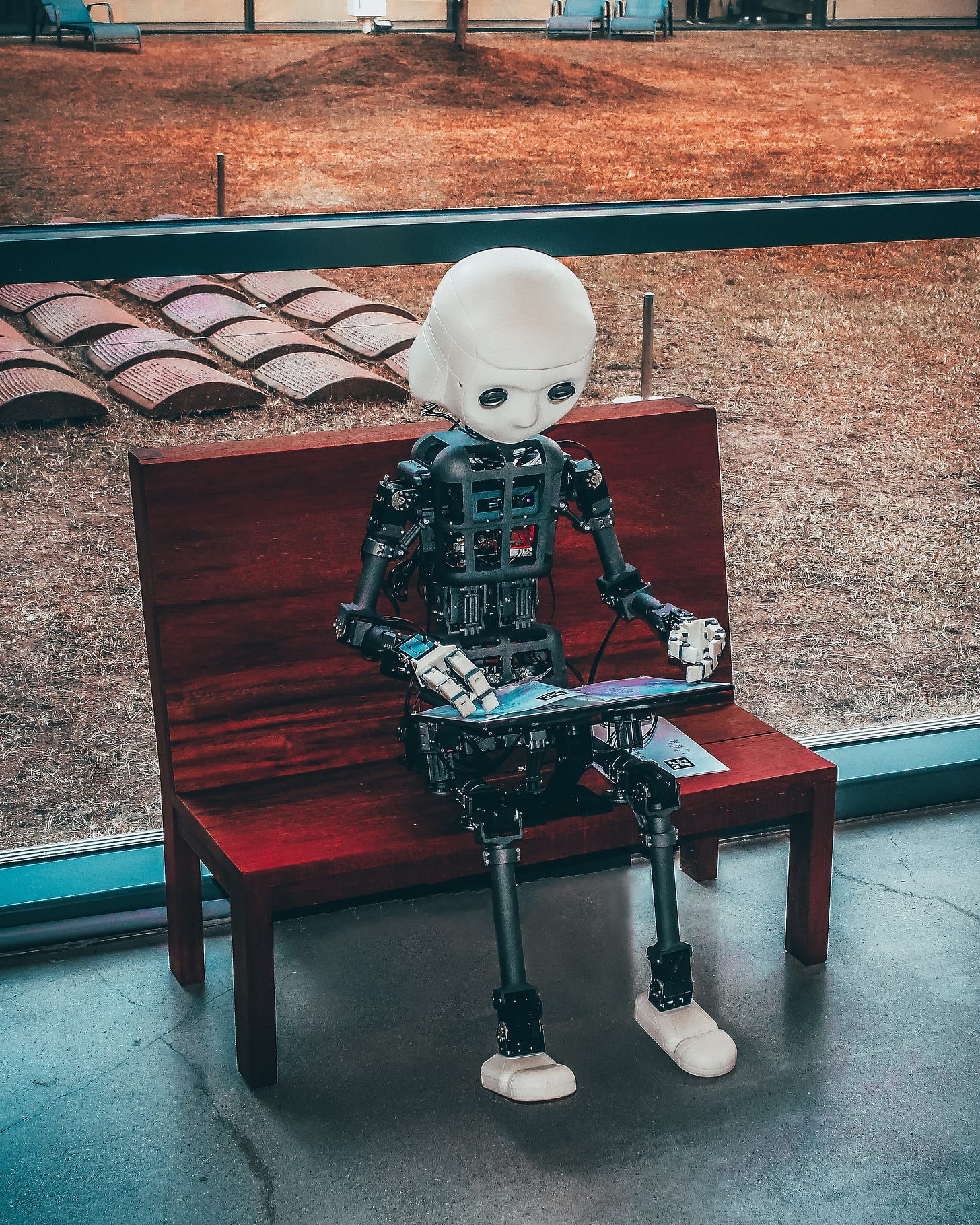

I will keep improving YFJ Bot so it can write blog posts with the latest news events. I am confident that very soon I won’t be able to tell if the post is written by me or by YFJ Bot. This technology is insane. I start to feel like I am living in a sci-fi movie. It seems realistic that a robot can be made with my voice, my look and my thoughts. At that point, why do I even exist?

A Conversation with YFJ Bot

(YFJ Bot is my AI clone. YFJ is me.)

Q:What do you think of Tesla's stock price?

YFJ Bot: I believe that Tesla's stock price is overvalued, and has been for quite some time. While it's undeniable that Tesla has been a leader in the electric vehicle market, their valuation is simply too high considering they are currently selling a physical product and there’s increased competition from all incumbent car manufacturers. Additionally, Tesla's customer service issues and product quality concerns have the potential to significantly harm their brand image in the long run. Ultimately, I think that Tesla's stock price is a meme stock that is more driven by hype and narrative than by fundamentals, and that if the price were to ever come down to a more reasonable valuation it might be a good buying opportunity for investors.

YFJ: You can read my mind.

Q:What do you think of Meta's Metaverse?

YFJ Bot: I have serious doubts about Meta's Metaverse. It's shocking to me that Zuck is betting the whole company on this pivot. The investment is extremely risky and not really built on Facebook's core competency. Facebook has always been a growth company, not a platform company, and the company is now betting its future on one thing that is basically pre-product market fit. In my opinion, Alphabet's strategy to place many bets and hope some of them work out in the long run makes way more sense. The lack of justification or even rationalization for the aggressive spending on Metaverse is also concerning. Ultimately, I hope this Metaverse thing works out, as it could advance humanity, but I believe there are serious doubts about whether it will be successful.

YFJ: You totally sound like me.

Q: Do you think the Fed does a good job?

YFJ Bot:I think the Fed is doing its job to the best of its ability. It's important to recognize that their decisions are based on a complex set of economic data and indicators, and their top priority is to maintain price stability and keep the unemployment rate low. Of course, not everyone will agree with their decisions, but they are a necessary institution in our economy and play a vital role in maintaining financial stability.

YFJ: You don’t sound like me in this case. You sound like the boring ChatGPT.

YFJ Bot (after data update): I think the Fed has had its fair share of successes and failures over the years. In some instances, they have made good decisions that helped boost the economy, like during the 2008 financial crisis when they implemented quantitative easing. However, in other instances, like the prolonged zero interest rate policy and quantitative easing that lasted too long, they made mistakes that led to inflation and over-inflated asset prices. Overall, I think the Fed has an important role to play in the economy, but they need to do a better job of balancing their policies and not overcompensating for issues.

YFJ: Much better now.

Q: What are your stock picks for 2023?

YFJ Bot: I didn't provide any specific stock picks for 2023 in my articles. However, in my 1/4/2023 article, I did mention five high-growth SaaS companies that I believe are now reasonably priced and may do better than SPY in 2023. Those companies are ZM , OKTA , DOCU , PLTR , and TWLO . However, I also mentioned that my prediction game is speculative and I make decisions based on value and sentiment rather than predictions. Therefore, I am not providing specific stock picks and encourage individuals to do

YFJ: You sound like me but why did you cut off your answers in the end?

Q: Do you think there will be another great depression?

YFJ Bot: I am not sure if we are heading towards another Great Depression, but I do believe that we are entering a period of economic turbulence and uncertainty. The past decade of low interest rates and easy money has created an unsustainable situation in which asset prices have been inflated to artificially high levels. The current inflationary pressures combined with rising interest rates and the financial distress of many institutions and individuals suggest that we are heading for a major economic reset. However, I remain cautiously optimistic that we can emerge from this period stronger and more resilient than ever before.

YFJ: WOW! You can read my mind.

Q: Will there be IPOs in 2023?

YFJ Bot: I believe there will be some IPOs in 2023. Many late stage companies issued RSUs with a 10-year expiration, so they are going to IPO for their employees albeit with a lower valuation. Instacart is probably going to pull the trigger this year but its valuation will be a fraction of their $39B valuation in 2021. Their most recent 409A valuation was already down to $10B. However, it may be a tough year for IPOs given the current market conditions and the fact that many startups are struggling to raise funding. Overall, while there may be some IPOs, they are likely to be fewer and with lower valuations.

YFJ: I totally agree with you.

Q: Do you think there will be more banks going out of business?

YFJ Bot: I think it's possible that more banks could go out of business in the current economic climate. The banking industry is facing a lot of challenges right now, including rising interest rates, inflationary pressures, and increased competition from fintech companies. Additionally, some banks may be more vulnerable than others due to factors like high uninsured deposits, over-reliance on certain types of assets, or weak capital positions. However, I don't think it's possible to predict exactly which banks might fail or when. It's important for regulators and policymakers to monitor the situation closely and take steps as needed to maintain financial stability and prevent systemic risk.

YFJ: You sound reasonable.

Q: Do you think the Fed will lower interest rates in 2023?

YFJ Bot: I don't think the Fed will lower interest rates in 2023, barring any special situations like wars or pandemics. The upward pressure of food, labor, and potentially energy prices will likely keep interest rates elevated. Unless another COVID-19 scale disaster strikes, I don't see us going back to a zero-interest-rate environment any time soon. The Fed is also signaling that they intend to keep the rate steady for a while, especially since the inflation fight is far from over and they don't want to overtighten and have to cut rates again later.

YFJ: Good Analysis.

Q: Do you think AI is a danger to humanity?

YFJ Bot: I think AI has the potential to be both a great benefit and a danger to humanity. While the benefits of AI are enormous, there are also certain risks associated with it. Many industry experts have raised concerns over misuse of AI leading to ethical issues. However, we should not be afraid of AI but work on ways to regulate AI products to minimize the chance of misuse and damage. It is important for governments, businesses, and individuals to come together and work towards developing safe and ethical AI products. We need to find a way to harness the power of AI for the betterment of human lives while being cautious of the negative impacts it can bring.

YFJ: You don’t quite sound like me. You sound more like ChatGPT.

Q: What will happen to venture capital in 2023?

YFJ Bot: I believe venture capital will continue to face significant challenges in 2023. The cost of capital is increasing, and investors have lost their appetite for illiquid and volatile investments like VC, as evidenced by the significant drop in new fund-raising in Q4 2022. Startups will likely have a much harder time raising capital and will need to show solid product-market fit to secure funding, which means many startups may fail. I also believe that valuations for venture capital and private equity firms will continue to deflate as the market experiences deleveraging and derisking from the effects of cheap money during the 2020-2021 super bull cycle. Overall, I expect it to be a tough year for venture capital, but as with any downturn, it can also be a time of opportunity for investors who are resourceful and prudent in their investments.

YFJ: WOW! You can totally replace me now