7/20/2022: Netflix's Q2 Earnings is Better Than Expected

They were expected to lose 2M subscribers but only lost 1M.

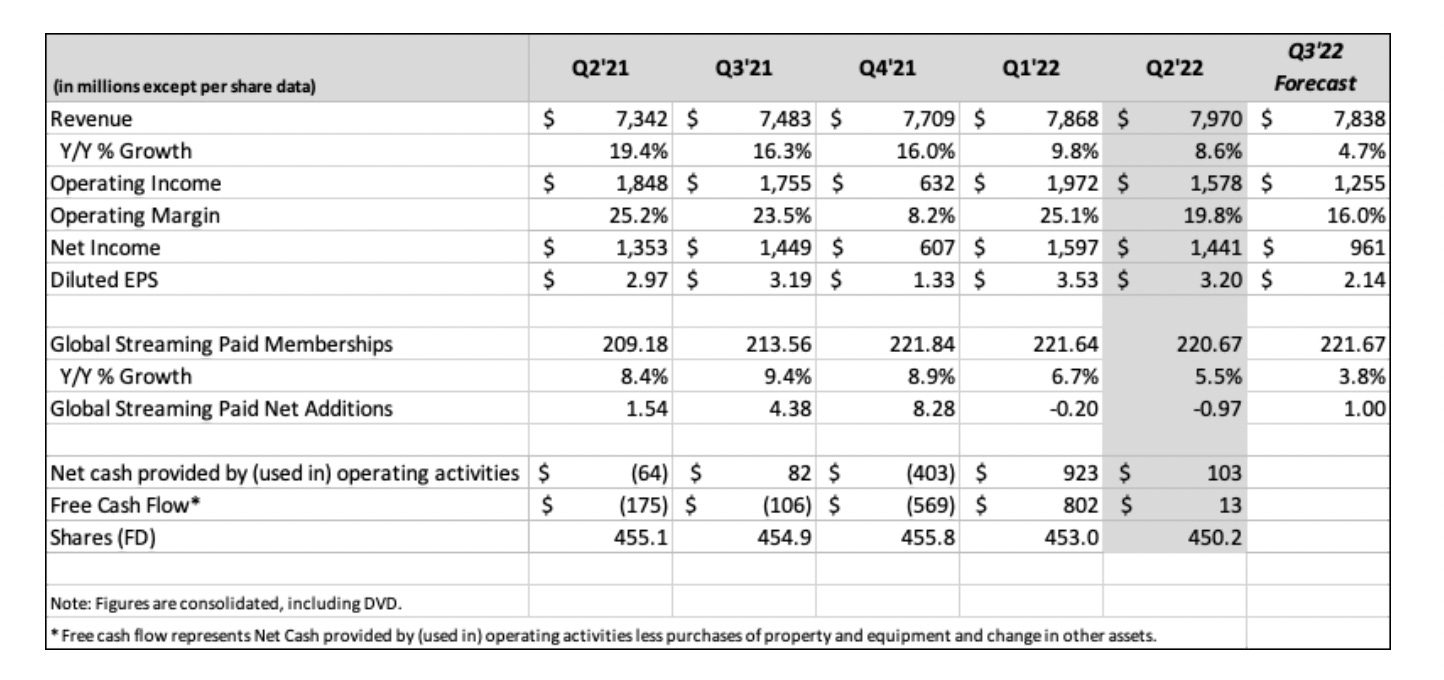

Netflix announced Q2 2022 earnings yesterday after the bell. The company lost 970K paid subscribers in the June quarter, fewer than the 2 million it had expected to lose. Netflix estimated it would add 1 million net new subscribers in the current quarter. NFLX 0.00%↑ stock went up today because of better than expected earnings. It’s still down ~65% YTD though.

Netflix’s current market cap is about $95B. Its Q2 revenue and net income is $7.97B and $1.44B respectively. Their PE ratio of ~16.5 is not too bad with the 8.6% YoY revenue growth. They barely have any free cash flow though. Free cash flow is $103M this quarter but historically it has been mostly negative. The main reason is that they have to invest in the original content to stay competitive. In the press release, they said they will decrease this investment overtime and become consistently cash flow positive going forward. Their current projected content-investment-to-content-amortization ratio is 1.25 for fiscal year 2022 . There’s quite a bit of accounting gymnastics going on here with regard to income and cash flow statements. If we just deduct all the content investment as spending (-$4.68B) and add back the content amortization (+$3.26B), the difference (-$1.42B) is pretty much their net income. In other words, they are not really making much money. Hopefully, they can reduce the ratio to one and have billions of cash flow per year. But before that, I don’t think NFLX 0.00%↑ is a stock I would own.

Netflix also mentioned that they are going to add a cheaper ad tier and paid sharing to super charge their subscriber growth. Apparently, they are running out of low-hanging growth opportunities that they have to resort to running ads and clamping down on account sharing. I suppose this growth chasing is the inevitable fate for all high growth public companies, which I found quite depressing. Netflix is a good product. I am a subscriber. I hope their product and user experience stay good after all these changes.

NFLX (earning call)

-main takeaway here is

1) their market is saturated at the current pricing structure

2) they will try and squeeze more revenue out of shared accounts by allowing people to add multiple houses to an account

3) they will try and expand their TAM by providing lower cost ad subsidized pricing tier

They need to be really careful here that #3 doesn't cannibalize their existing pricing tier. They seem to be doing lots of testing to reduce risk and will go market by market in their roll outs.

As you mention they have an FCF issue. If they can drive up revenue through above it could be interesting. Will the market give them forward looking credit, or has management trust been damaged and they want to see results first?