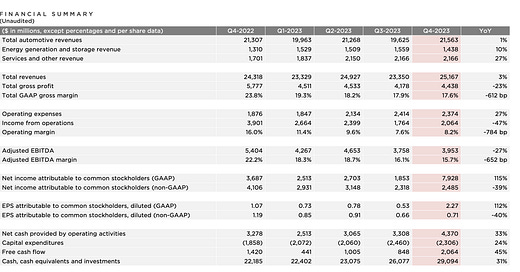

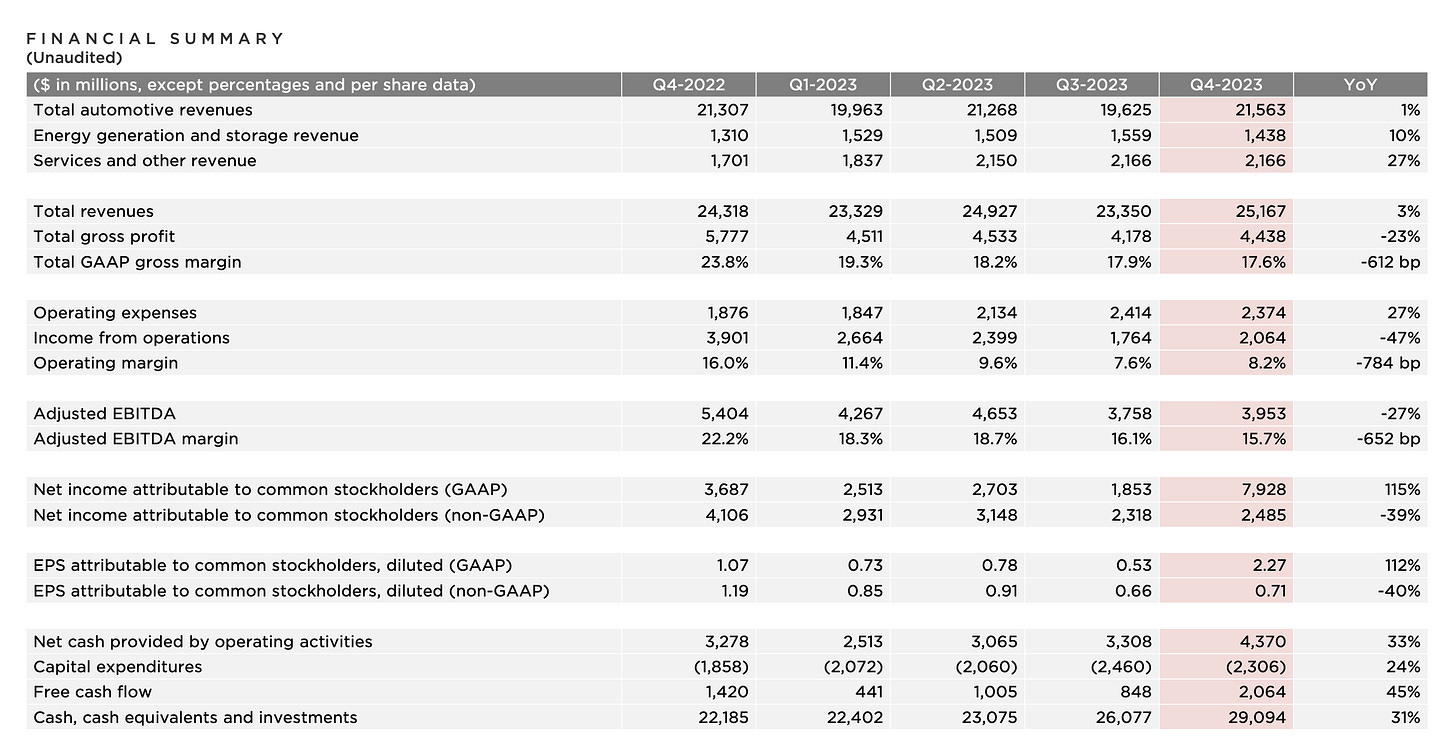

Tesla reports Q4 earnings after market close today. Revenue was $25.17B vs. $25.6B expected. Adjusted EPS was $0.71 vs. $0.74 expected. Revenue growth for Q4 was only 3% YoY vs. 37% a year ago. Gross margin and operating margin were both down significantly as shown above. TSLA 0.00%↑ tanked 6% after the disappointing earnings report came out.

TSLA 0.00%↑ stock is very expensive with the PE ratio > 50. With the non-existent growth rate, fierce competition from Chinese EV manufacturers and the high-for-longer interest rate environment, I don’t know how Tesla’s stock price could sustain at the current level. Tesla is an impressive EV/energy company but its growth narrative is fading. My prediction about Tesla stock going down has been wrong for the longest time. But I might finally be right this time.

(clarification: TSLA, but not SpaceX)

very few folks brave enough to short Elon but now is prob the time