2/13/2023: Palantir is Finally Profitable

EPS/Revenue also beat expectations

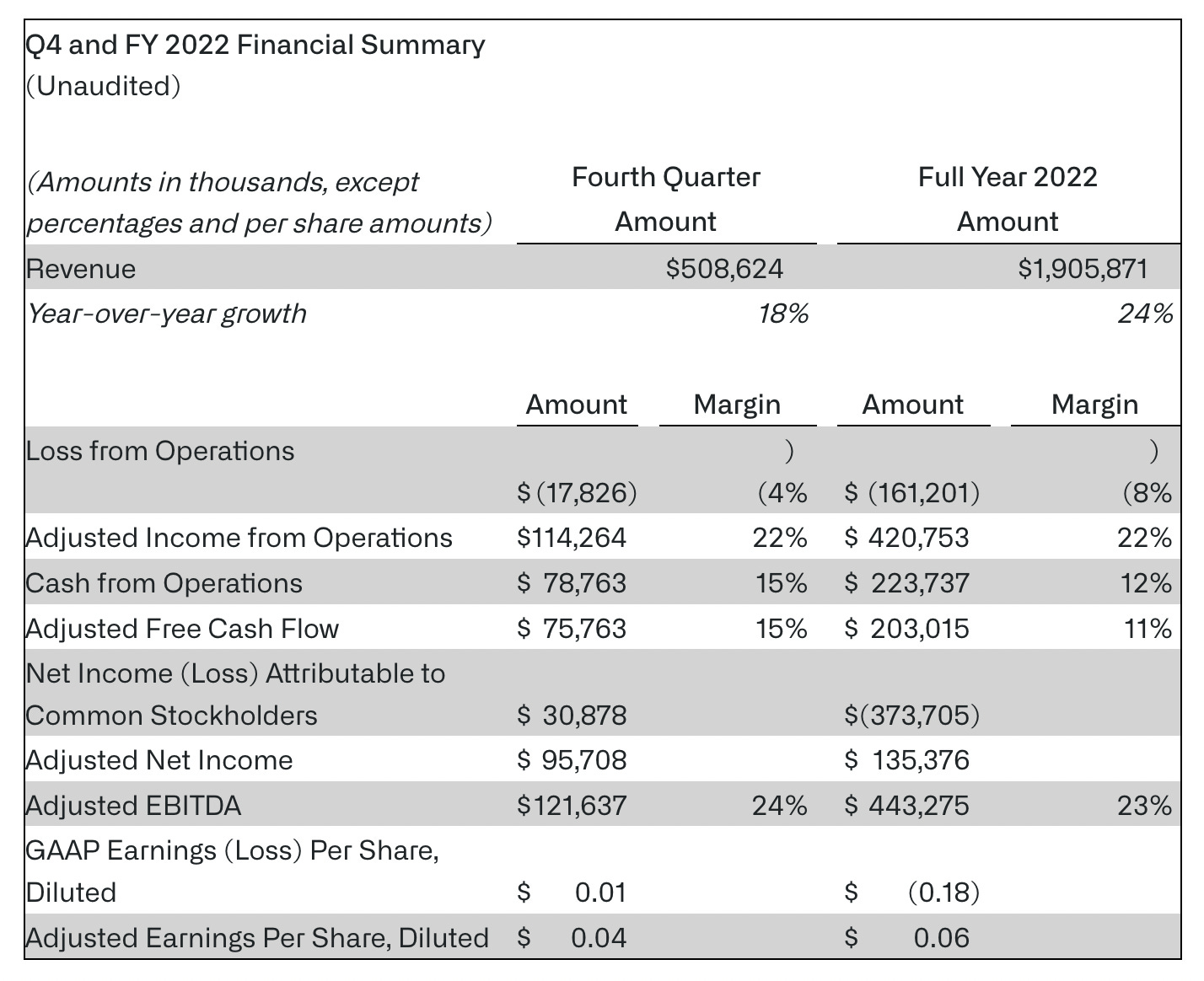

Palantir reports Q4 2022 earnings after market close today. They finally have their fist profitable quarter with GAAP income equal to $31 million after all these years!! EPS was 4 cents vs. 3 cents expected. Revenue was $509 million vs. $502 million expected. PLTR 0.00 stock soared 15+% after the report.

As mentioned earlier this year, I believe many SaaS stocks have bottomed. With the Enterprise Value to Sales ratio around 6, 20+% annual top line growth and high retention, I believe PLTR is reasonably priced. The stock closed at $6.42 at the end of 2022 and was trading at $8.88 after hours today, a 38% increase. I still believe the battered SaaS stocks will do well this year because the sentiment was way too negative. The environment was a bit harder for these stocks but it’s really not as bad as investors expected. SaaS stocks that are traded with a low revenue multiple and have actual moat are set to soar. I don’t know how much further they will go but chances are they will do better than S&P 500.